Are you off travelling again, now that we’re ‘living with covid’? Even if you’ve never bought travel insurance before, if you travelled during the pandemic, many countries required you to purchase travel insurance as part of their entry conditions. As a result, the providers have tapped a captive market and are now selling travel insurance post covid with a wider range of benefits, some including covid cover, others offering it as an add on.

Travel insurance post covid

We had a look at a few on offer in Malaysia and selected these three well known companies to compare, all of which we’ve used before. It is always wise to check a few options before you buy as the differences we discovered very likely occur elsewhere.

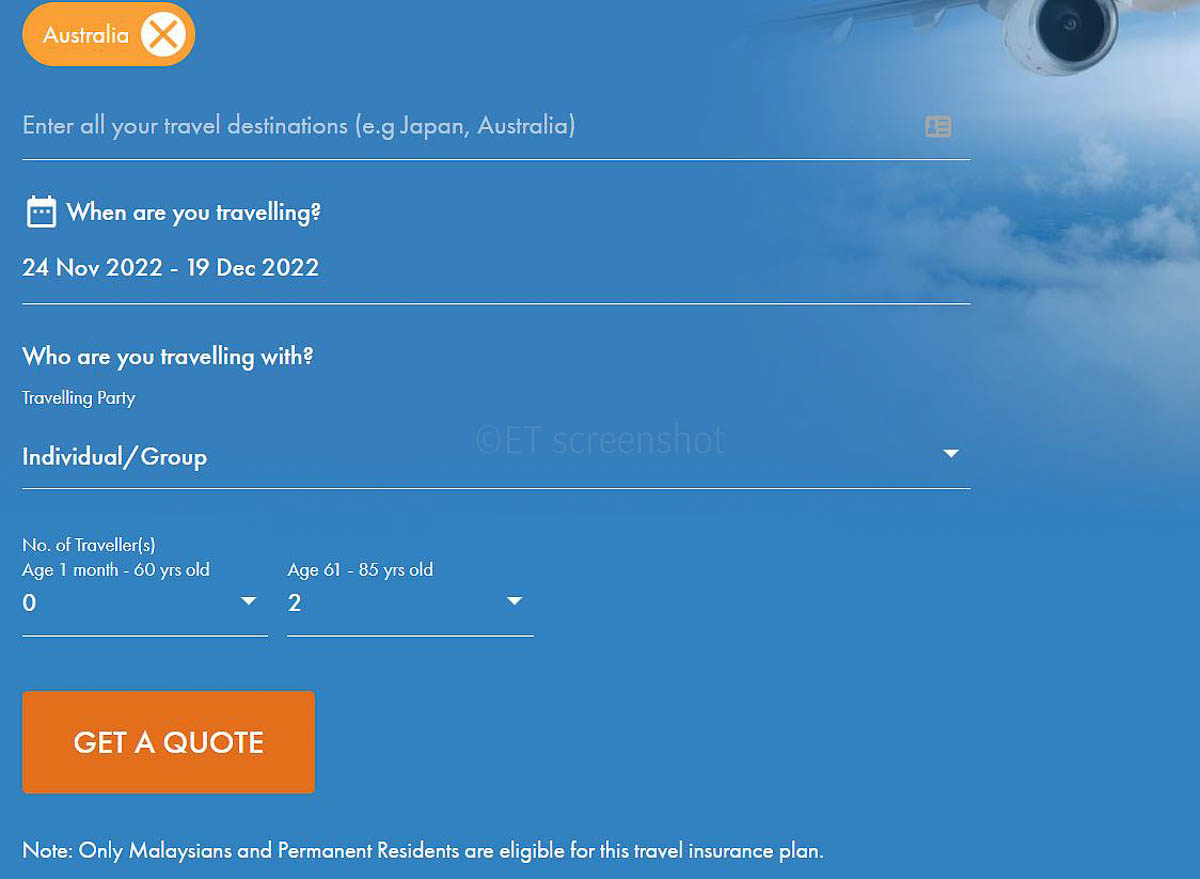

In the interest of fairness, we chose a sample trip with the same dates (24th November – 19th December 2022) and destination (Australia) for 2 travellers. For each provider, we looked at the two age groupings on offer (normal policy and Senior policy) and found a wide difference in both offerings and pricing. Our results are shown below in alphabetical order. If you have travellers in your party in both age categories, you’ll need to purchase the policies separately. However, unlike pre-covid days, two people can now be considered a group if they’re in the same age classification, which makes booking much easier than doing separate policies.

AIG

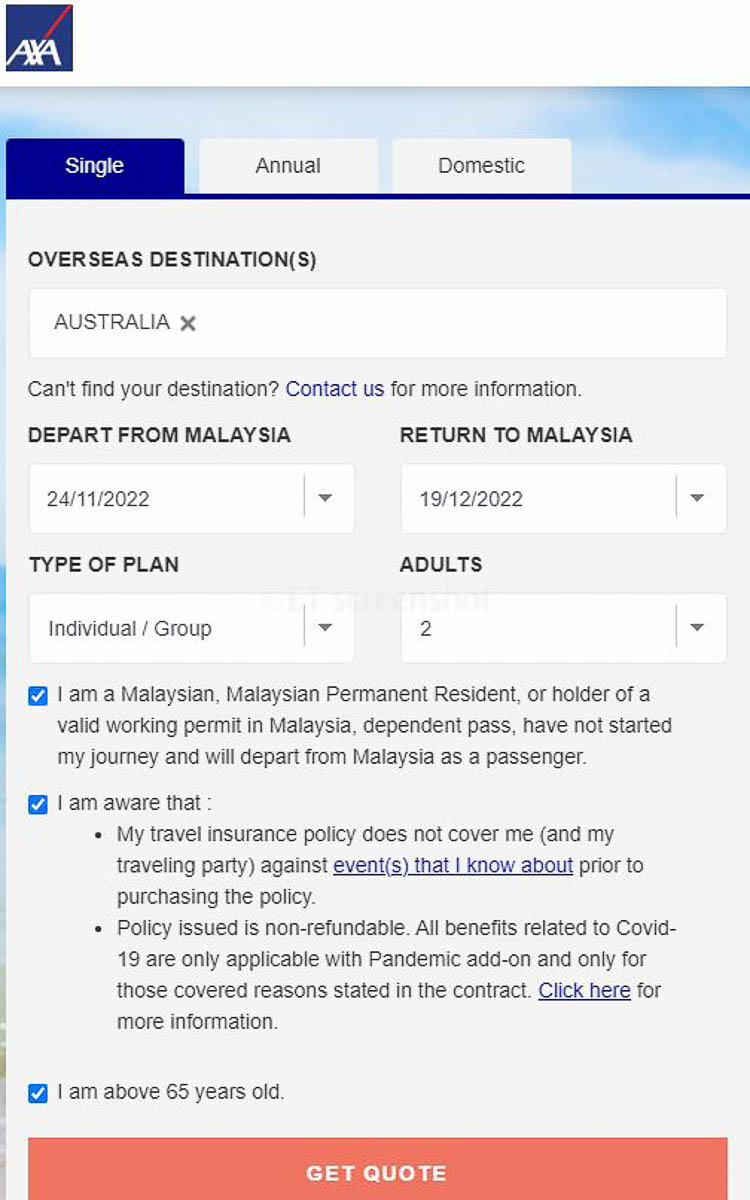

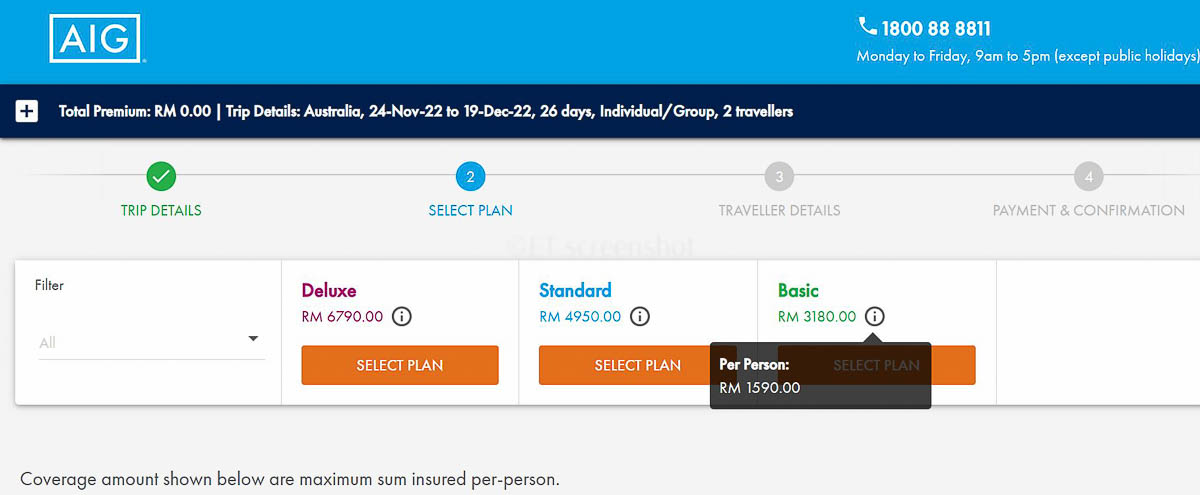

American International Group, Inc. (AIG) is a leading global insurance organisation, operating in Malaysia as AIG Malaysia Insurance Berhad since 1953. They have fifteen offices in Malaysia. Their travel insurance page has a comprehensive FAQ section and a link to purchase online or choose an agent if you prefer. If you wish to purchase online, the first screen asks you for your travel plans and select the appropriate age grouping.

The AIG policy is available to travellers between 1 month old and 60, with Seniors are accepted between the ages of 61 and 85. Only Malaysian Citizens and Permanent Residents are eligible to purchase AIG travel insurance. It’s not available to anyone over 85, or other types of Malaysian residents (Employment pass, student pass etc). We did try the AIG Australia travel insurance website to make a comparison, only to find they are currently not selling policies because they are doing a website maintenance. One thing we did note is that the policies (when available) are only for those below 70.

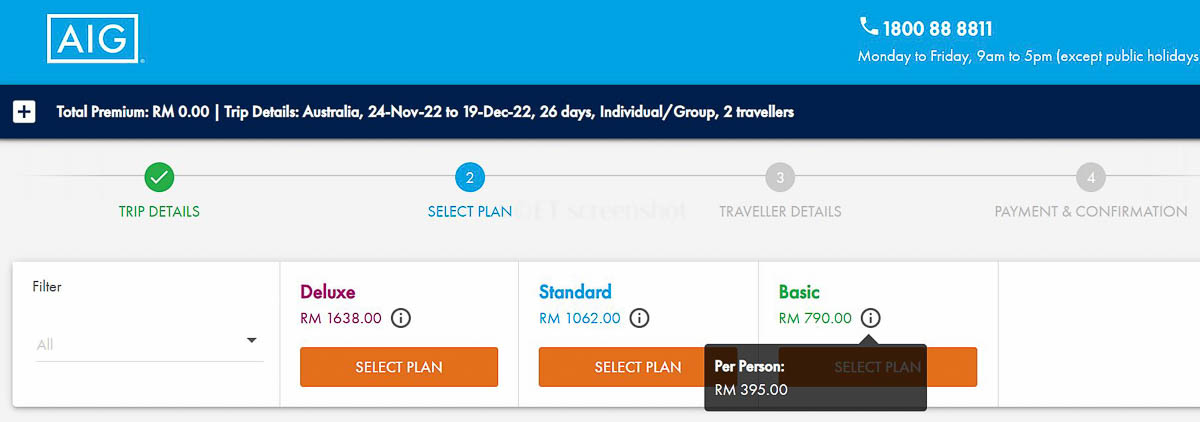

The benefits offered are quite comprehensive and the amount of cover is the most generous of the three surveyed in most categories. It is also the most expensive of the three. Covid cover is bundled into each plan. Medical expenses in Malaysia, a Compassionate visit and ‘Child guard’ are not included in the Basic Plan. All three plans do include overseas dental services. There is a personal liability benefit of RM 1,000,000 for deluxe and Standard plans, halved for the basic plan.

Although benefits appear to be the same for both groups, a policy for travellers in the seniors group is an eye-popping four times the price of one for younger people.

AXA

AXA is a global company offering a range of insurance products across 50 countries. They have operated in Malaysia since 1975 and AXA Malaysia was fully acquired by Generali Group in August 2022. You can check out AXA offerings in other countries as they have this handy map showing where they operate.

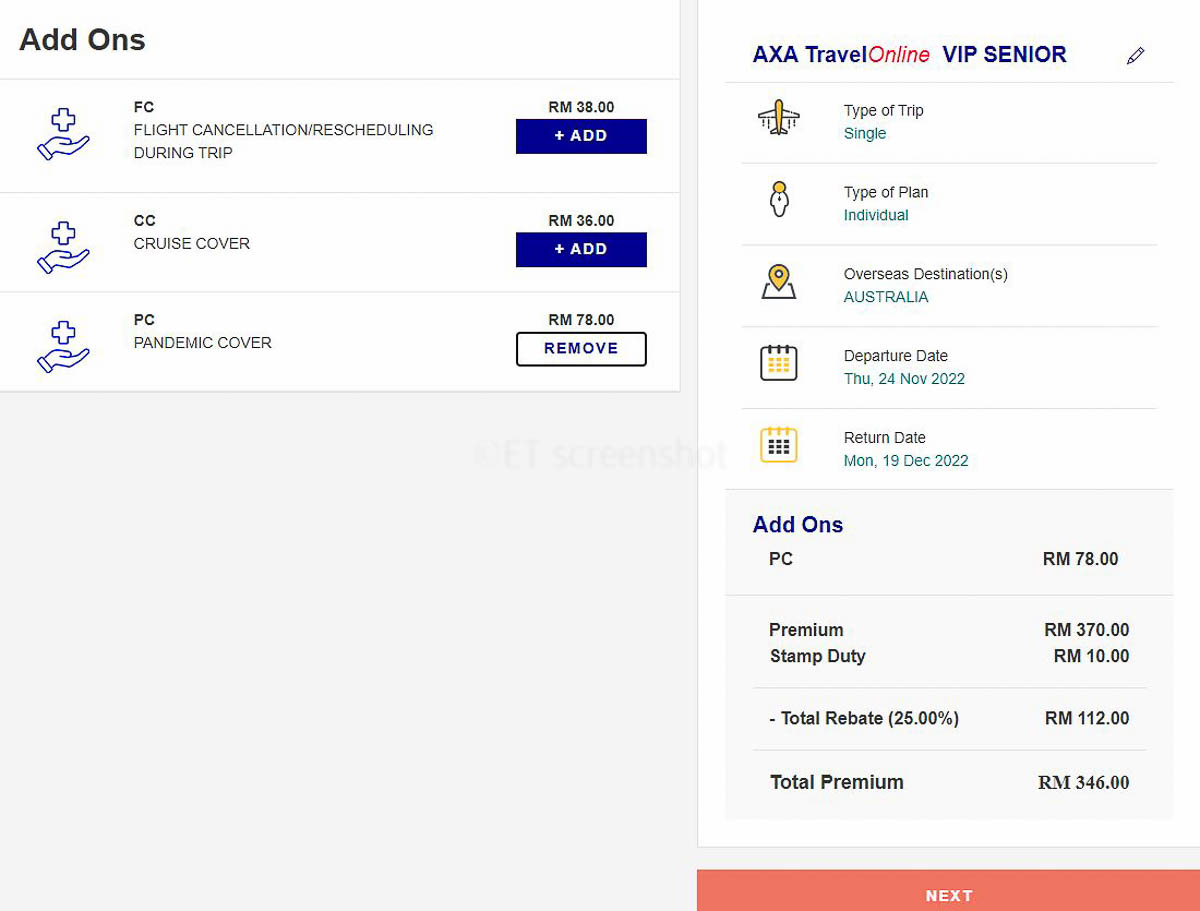

AXA offers the same benefits for non-medical items in their plans for both normal policies and those for Seniors, (65 years – 80 years old). However, Medical expenses (with does include dental) and Personal accident benefits are halved for Seniors in both VIP and Classic offerings. The hospital allowance for seniors (VIP plans only) is around 70% of that for normal policies. If you’re worrying about hijacking, this is also covered in an AXA VIP policy, with both age groups receiving the same allowance for inconvenience and payment of ransom. Both groupings include RM1,000,000 for Personal liability.

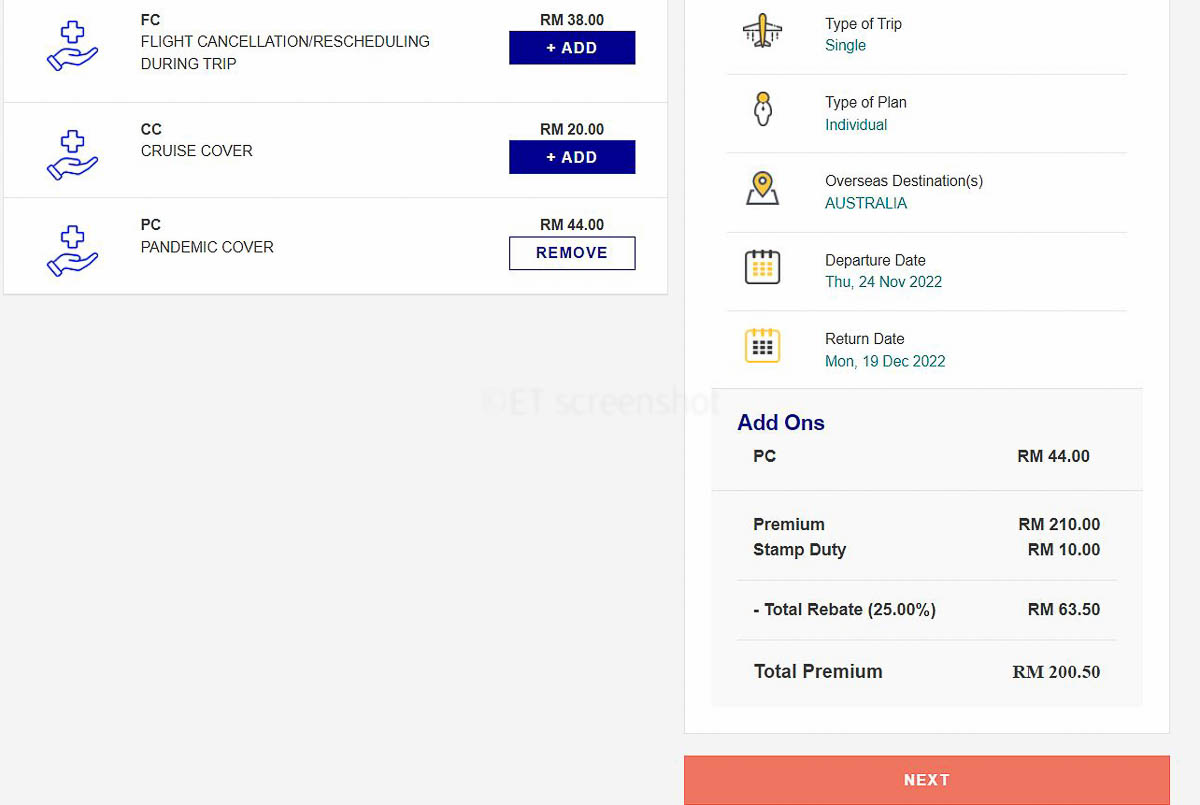

Specific Covid cover is not included in the policy, but is available as an add-on, as are Cruise cover and cover for flights cancelled or rescheduled during the trip.

Get all the information for different plans on this link for Individuals, Families or Domestic travel. There’s also a button at the bottom of the ‘get quote page’ https://digital.axa.com.my/travel-insurance-malaysia where you can choose your plan and follow the link to purchase. AXA’s policies are available to Malaysian residents, whether citizens, permanent residents or on various types of resident visas.

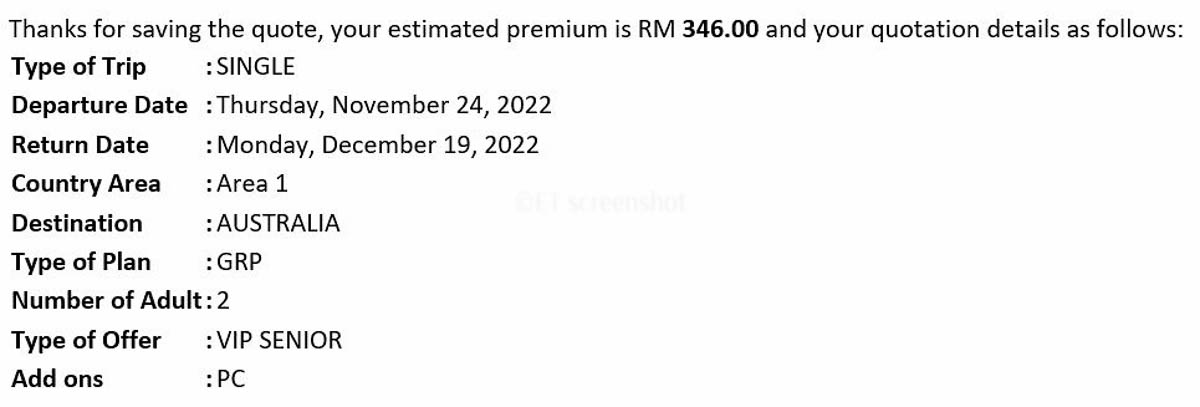

Get your quote here, and you can also ask them to send it to you by email as well.

Your quote also includes the breakdown of the charges including any add-ons.

They will also email you your quote, in case you want to think about it. There’s a link to continue where you left off, in the email.

The emailed quote also confirms that this is the cost for two travellers. Of the three we looked at, AXA offered the most benefits and the most competitive cost, even including the addition of the optional Pandemic cover.

Tune Protect

Tune Protect Re Ltd is involved in non-life reinsurance business, with a particular focus on travel insurance policies for the customers of its partners. It’s closely allied with the AirAsia Group, also founded by Tony Fernandes and Kamarudin Meranun in 2001.

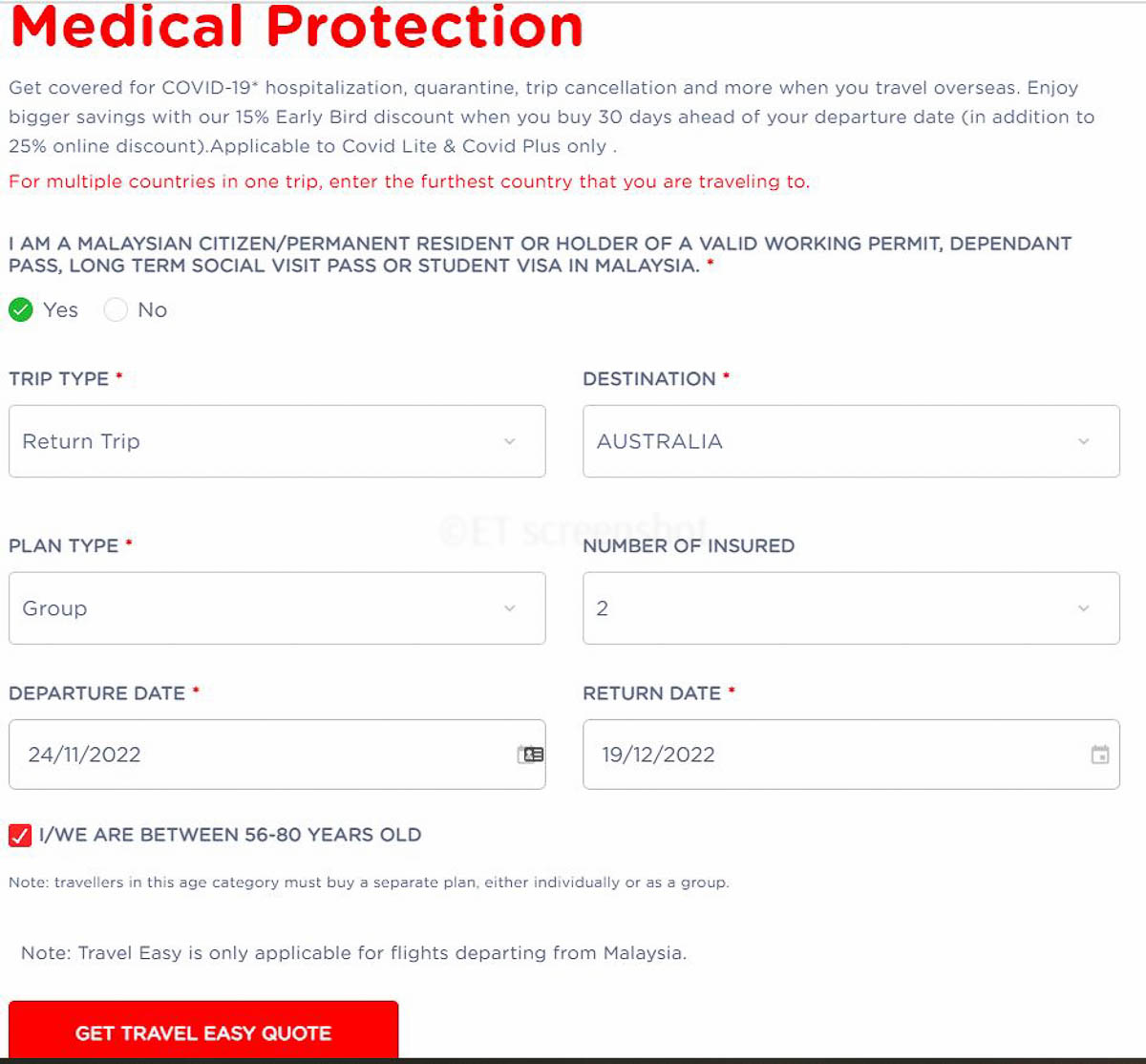

Tune Protect is the main provider for AirAsia flights, and you can select a basic cover from their check-out page when booking your flights. For a more comprehensive travel policy, they offer three levels of protection, divided into a normal policy and a Seniors offering for travellers between 56 and 80 years old. Their Travel Easy page opens up at the ‘Get quote page‘. You can also access the quote page via this page, which also has a link to download the app for iPhone and Android.

Apart from becoming a Senior at age 56, their plan is, like the other providers, also double the cost of the normal plan, although the same benefits appear to extend across the two age groupings. The pricing includes 25% discount for online purchase, and an early bird discount for purchase more than a month before travel.

This page has all the information, and quite a comprehensive FAQ section along with a a link to plan details. Tune Protect also offer a Covid travel plan available for visitors to Malaysia visitors to Malaysia.

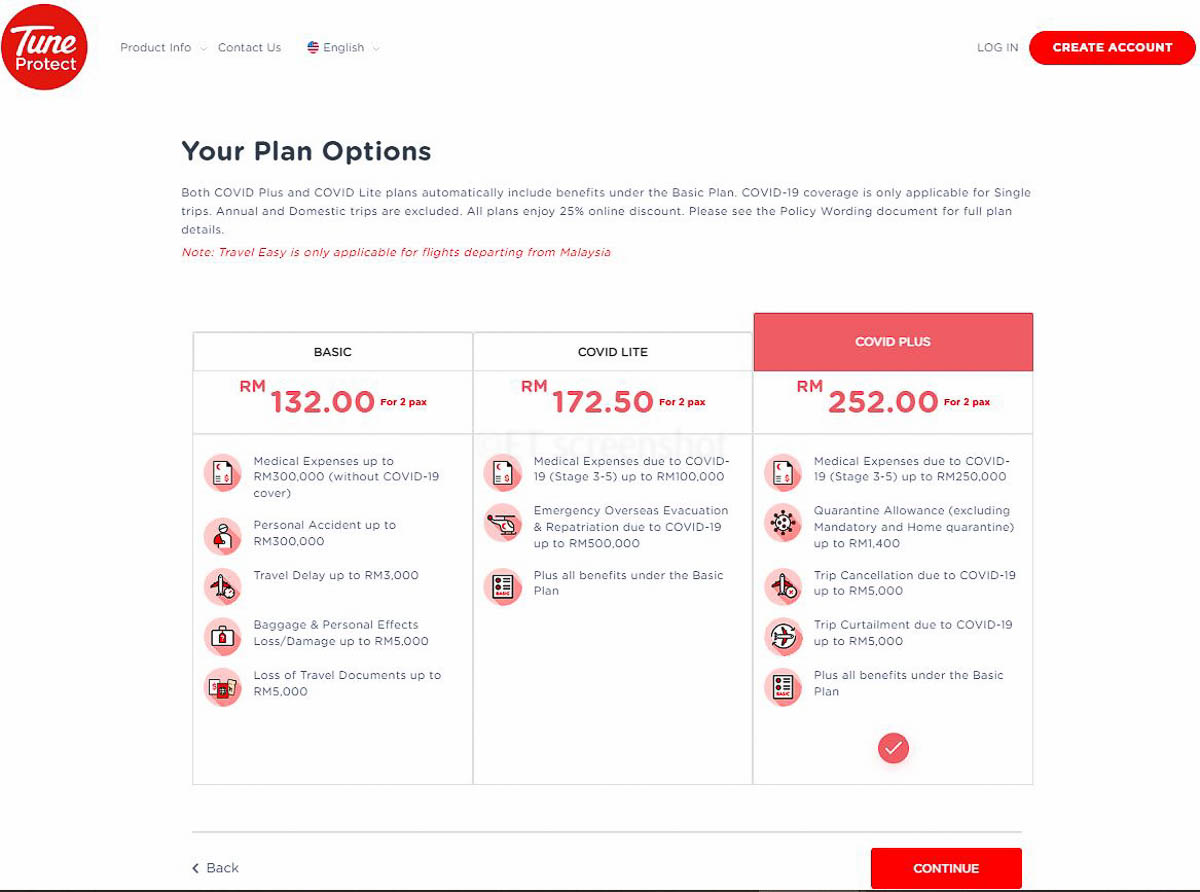

This is the pricing for the policy for a traveller aged below 56.

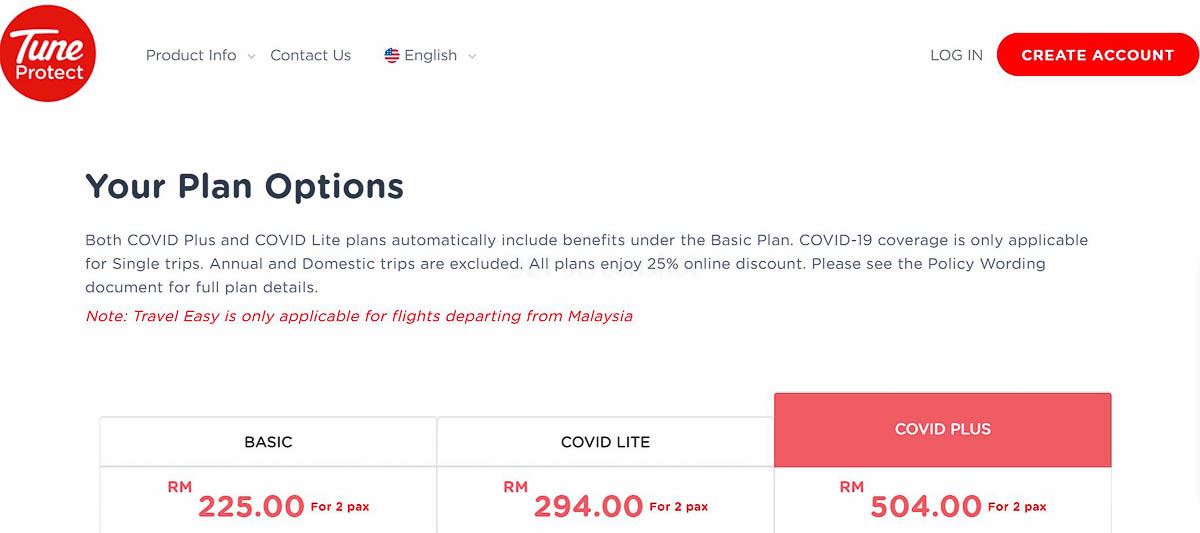

If you are aged between 56 and 80. this is what you will pay for two tavellers

xxxxx

xxx

The Tune Protect policy appears to offer the same benefit for seniors and younger travellers in the same category. However the cost of the policy is exactly double. There is no personal liability benefit included in the Tune Protect plans, and no hospital benefit for the Basic plan. Generally, the range of benefits is lower than those offered by the other two providers.

Conclusions

It’s now much easier to purchase travel insurance online and most companies will offer a discount as they consider you an ‘agent’ for doing it yourself. The amount of discount varies and should be shown in the breakdown of fees.

All three companies offered different policies based on the age of customers. However, each company had a different ‘cut off’ point and two do not offer a policy above the age of 80 or 85. This should be made clear at the ‘get quote’ page.

There was no differentiation based on health considerations although all companies exclude prior conditions from their cover. But you my have to read the fine print to be aware of this, it common in any policy offering medical benefits.

Two companies offered reduced medical benefits for ‘Seniors’ although all ‘senior’ policies were more expensive.

To our readers – if you have comments about this story or are able to offer examples of your own experience looking for travel insurance post covid in different countries, we’d love to read and share your experiences through our Comments.

Please note: Economy Traveller has no interest in any of the businesses mentioned and the material shared here is from our own research. The information provided is for readers to use as a starting point to help them make an educated choice.

This Post Has 0 Comments